georgia ad valorem tax motorcycle

5500 plus applicable ad valorem tax. According to Chapter 22 of Publication 17 the IRS allows you to deduct the ad valorem tax vehicle value off your income taxes.

![]()

Georgia New Car Sales Tax Calculator

Ad valorem tax more commonly known as property tax is a large source of revenue for governments in Georgia.

. 393 Type of Motorcycle Currently Riding. Owners of vehicles that fit this category can use the DORs Title Ad Valorem Tax Calculator tool to calculate their. Do I have to pay the Georgia ad valorem tax on a leased vehicle.

The basis for ad valorem taxation is the fair market value of the. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. Cost to renew annually.

Learn how Georgias state tax laws apply to you. This calculator can estimate the tax due when you buy a vehicle. In South Dakota we pay a one-time 3 excisesales tax the first time we register a vehicle.

As of 2018 residents in most Georgia counties pay a one-time 7 percent ad valorem tax on these vehicles at the time of purchase. As of 2018 residents in most Georgia counties pay a one. Buzzfeed county name quiz.

Registration Fees Taxes. In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later. Jan 14 2015 1.

2021 Property Tax Bills Sent Out Cobb County. For the answer to this question we consulted the Georgia Department of Revenue. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

80 plus applicable ad valorem tax. Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and. Motorcycles may be subject to the following fees for registration and renewals.

If your vehicle passed emissions inspection and. Georgia Ad Valorem tax Discussion in Victory General Discussion started by Bobbyd85 Jan 14 2015. Of the Initial 80 fees collected for the issuance of these tags the fees shall be.

The amount is calulated on the purchase price less any trade-in value. Ad Valorem Vehicle Taxes If you purchased your vehicle in Georgia before March 1 2013 you are subject to an annual tax. In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later.

For tax year 2018 Georgias TAVT rate is 7 prtvrny. If renewing in person you will have to show your Georgia Emissions Inspection Certificate. Georgia Department of Revenue gives in depth information on the exact required amount of fee particularly the amount you have to pay as an ad valorem tax which is based on the current.

Are There Any States With No Property Tax In 2022 Free Investor Guide

Tavt Information Georgia Automobile Dealers Association

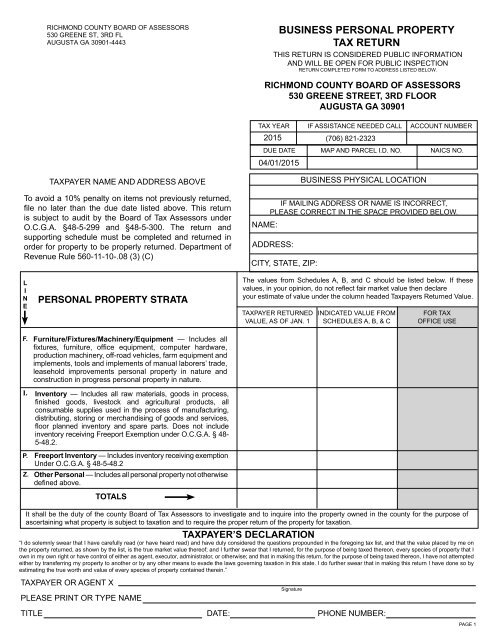

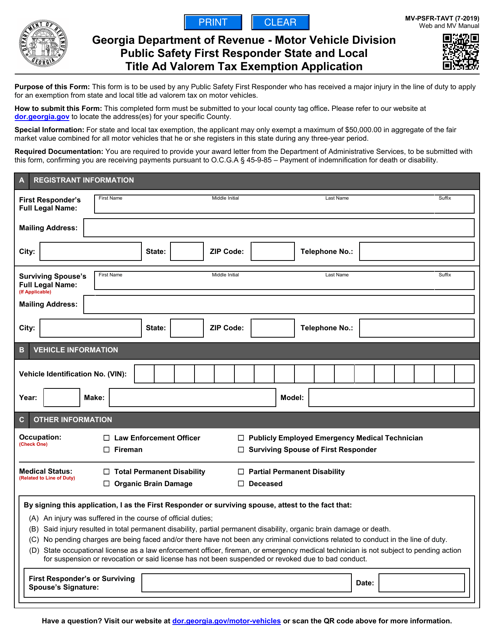

Form Mv Psfr Tavt Download Fillable Pdf Or Fill Online Public Safety First Responder State And Local Title Ad Valorem Tax Exemption Application Georgia United States Templateroller

Dawson County Tax Commissioner Nicole Stewart On Twitter Support Our Troops Tag Initial Purchase Is 80 00 25 Manufacturing Fee 35 Special License Plate Fee 20 Registration Fee Ad Valorem Tax If

Georgia Title Ad Valorem Tax Updated Youtube

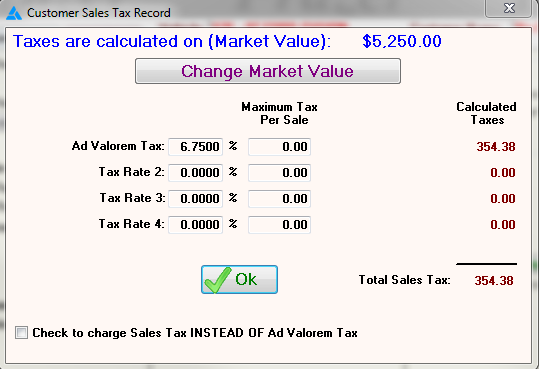

Frazer Software For The Used Car Dealer State Specific Information Georgia

Georgia Used Car Sales Tax Fees

Updates To Georgia Lease Tax Canton Ga Serving Alpharetta And Atlanta

Car Tax By State Usa Manual Car Sales Tax Calculator

Tangible Personal Property State Tangible Personal Property Taxes

Georgia Commissioner Directs Insurers To Pay Full Amount Of Tax In Totaled Vehicle Settlements Repairer Driven Newsrepairer Driven News

Motor Vehicle Registration Pickens County Georgia Government

Tag Office Coweta County Ga Website

Georgia Title Ad Valorem Tax Fee Informational Bulletin Mvd 2013

How Much Are Tax Title And License Fees In Georgia Langdale Ford

What Are New Georgia Lease Laws Ga Car Dealership Near Me

Form Pt 472ns Fillable Non Resident Saervice Member S Affidavit For Title Ad Valorem Taxes For Motor Vehicles